Doing Business in Latvia Legal Guide let you:

- learn more about Latvia tax and business culture

- learn more about European development

- book your Hotel with special conditions (see at the end of the article)

- give you a conference space for your event quickly

- check upcoming fair trades in Riga

A film about Latvia in business we like

Latvia, one of the best country for starting a new business in Europe. Ease to doing business in Latvia is ranked 19th in the world according to The World Bank in 2018. That´s even better than in Germany. The Nordic Baltic countries are pearl of Europe. Let´s see why Latvia.

Invest in Latvia

If you want to invest in Latvia, or move to this beautiful Baltic country, here are some steps you may wish to consider as you get started. You can read this article and find the guide inside, or meet directly B2BALTIC in Riga. Several companies, mentors, legal advisors, geeks in their industrial sector, top recruiters are with us in the Latvian community. If you are going to invest big capital, you should definitevely arrange a meeting with the investments advisors of B2BALTIC or watch the Investors TV made by B2BALTIC TELEVISION.

Some important details about Latvian

Latvian are almost 2 million population belonging to the group of the high-income countries of the world. The spoken languages are Latvian, Russian, English. Almost anybody can speak both 3 languages. Baltic people have a native talent for languages. Not rarely you can find Latvian speaking also German, Swedish, Spanish and Italian. The German language was administrative language together with Russian one century ago. In Latvia is not complicated to form and launch any new business, to register a new property, to pay the tax, to get base credit, and to do trade across borders. The minimum capital requirment is 1 Eur to form a limited company LLC (SIA). If you deal with construction permits, something changed in the last years because of many speculations that left abandoned unfinished buildings around the country. But it´s rank 49th in the world, still not bad considering that for example in Italy it is “two times” more difficult. Latvia is also pulsing heart of Baltic business networking as reminded by “Baltic sponsor” Daniel Richard (DJ) Janetschek in the interview made by Radisson Blu Magazine in Dublin. Latvian are in general excellently open to creating international events about politic and business.

Import/Export in Latvia by sector and country

Latvia imports especially machinery and appliances, electrical equipment, transport vehicles, chemical, mineral products and prepared food. It imports goods mostly from Lithuania, Germany, Poland and from the Nordic countries. Outside Nordic Baltic area the biggest exporter to Latvia is Italy before China.

Taxation

In Latvia the minimal monthly wage is 430 Euro since 2018. Latvian residents are liable to personal income tax that is withheld at source and remitted to the tax authorities at a flat rate of 23%. Income from capital gain is taxed at a rate of 15%. An employer has to withhold social tax on a monthly basis at the rate of 23,59% of gross income. The total tax payable is 34.09%, so the employee must contribute 10,5%. Expatriates employed by non-resident employers are subject to social taxes of 32%. The self-employed rate for social insurance payments is 30.58%. Starting from 2015 maximum subject to social tax is set at 48 600 Euro. The minimum amount of the object for mandatory contributions of self-employed persons is twelve minimal monthly wages. The real estate tax rate is 0,2-3% from the cadastral value (general value set by state authority) of land, buildings or their parts and engineering structures. If the cadastral value does not exceed 17000 Euro the tax rate is 0,2%; if the cadastral value is from 17000 Euro to 107000, the tax rate is 0,4%.

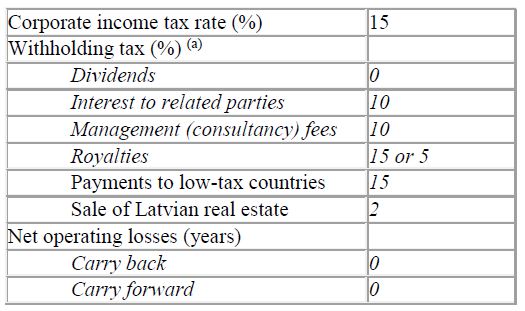

Additional tax at a rate of 1, 5% applies to uncultivated agricultural land, excluding land with space less than 1ha. The minimal real-estate tax payment is 7 Euro. VAT rate are 21% (goods/services), 12% (imported products), 0% (selfconsumption). Excise tax on soft drinks EUR 7.40 per 100 litres, coffee EUR 142.29 per 100 kilograms, beer EUR 3.8 for every percent of alcohol per 100 liters minimum EUR 5.69 per 100 liters, wines EUR 70 per 100 liters. The corporate income tax is reported in the following table. Enterprises are subject to corporate income tax at a rate of 15%.

Why investing in Latvia?

Over the last years Latvia has experienced an extensive economic growth in all sectors. The highest priority objective of the program is the direct foreign investments (FDI), which is the key to a fast and successful economic recovery. Latvia is NATO member since 2004. The strategic geographical position in the center of the Baltic area provides big accessibility to the large and rich Nordic markets. Latvia has highly educated and multilingual workforce, with a northern European culture and work ethic, historical developed business knowledge and experience with Russia/CIS. Workers here are ready to take on new challenges and, even more in the current circumstances. Employees are highly motivated althought the wage is one of the lowest in EU. Latvia’s workforce is rated in the top five in the world in terms of university students per capita and possesses a northern European culture and work ethic, excellent skills and discipline. The Latvian multilingual talent plays an important role. Renewable energy, ICT, Woodworking, Construction materials and industrial real estate offer high business opportunity in Latvia.

Logistics

In terms of logistics, Latvia is one of the best locations to establish a business in Northern Europe. Riga itself is the largest city in the Baltic States and is ideally located at the centre of the region. It´s European Union boarder with Russia, providing Ice-free ports, a fastest growing airport in Europe RIX which offers direct flights to more than 80 destinations, plus a well developed transport infrastructure in Riga free port. The Trans-Baltic highway (Via Baltica) connects directly to Moscow. Latvia has four separate Special Economic Zones (three ports and one inland). All are well connected to transport systems. Zones offer corporate tax discounts (as much as 80%) as well as 0% rates for VAT, customs and excise duties to companies setting up there. Special government funding programs are available to assist export-oriented business activities. To learn more about logistics assistance in B2BALTIC community read the article or contact us.

Immigration and Residency in Latvia for non-eu citizen

The following forms of temporary residence permit are the most common to obtain a 5 years residency. If investors purchase and own a piece of real estate (functionally bounded with buildings) worth over 250000 EUR. If a person (individual) invests at least 150,000 EUR or 35,000 EUR in the share capital and a company. If a person (individual) invests at least 280,000 EUR in a credit institution for (at least) 5 years (without rights to discontinue this investment earlier). More details about Latvian immigration and residency for EU and non-EU citizen you find in this complete article by B2BALTIC with lawyer Valters Gencs.

Information and communications technology

Latvia has one of the fastest telecommunications infrastructures in the world, providing companies seamless connection with customers and partners abroad. Indicative rankings include: 5th globally for average measured Internet connection speed and 7th globally for broadband connectivity. In Latvia the avarage internet speed is 16 Mbps. This is a great value considered that in Italy is 7 and germany is 13.

Cost Effectiveness

Latvia offers significant cost advantages to investors, including competitive labor and real estate expenses, as well as competitive tax rates. Coupled with strong productivity in manufacturing and services, Latvia provides investors with a highly cost-effective environment for business, producing compelling returns on investment. In Real estate sector, overhead costs have decreased significantly in recent years, particularly for construction, office space and industrial real estate.

Riga Conference, the highlight business & political event in the Baltics

The Rīga Conference has taken pride in itself as the meeting place of local and global elites since its inception in 2006. In the past, it has been honored with the presence of countless heads of state, heads of government, ministers, NATO and EU officials, and ambassadors from all around the world. Over the course of the last years, The Rīga Conference has built its name and reputation. Highlights have included having the Prime Ministers of Latvia, Poland, Estonia, Lithuania, and Finland together in the same room to discuss economic growth and international trading opportunities.

Riga according to Radisson Blu and Baltic sponsor.

Radisson Blu International Magazine from Dublin comments the opinion of Janetschek (B2BALTIC) about Riga for business travelers and movers. Read here the complete interview.

Our best 5 star hotel in Riga we provide to our top business travelers in B2BALTIC

- Grand Palace Botique Hotel ***** in Riga located in the oldtown is since 2014 the recommended one from our community of exclusive business travelers. The hotel is also residence of Austrian Consulate of Riga. B2BALTIC organizes business events in this hotel. For corporate-travel-booking you can contact us for a special reservation for you: B2BALTIC Business Travels Department. During your stay you can ask B2BALTIC to provide you on site a lawyer, accountant or a field expert for the matter you care about.

Our 4 star hotel in Riga best event location with parking, fast airport access, panorama view.

Just 1 km far away from the old town, with great space, car parking, fastest access from the Riga airport RIX and with a majestic view lodge restaurant bar for B2BALTIC Members, Business Travelers and Corporate groups in need of several type of conference spaces. For booking you can contact us to apply a business discount plus access to business conference rooms (any size with all equipment for talks and presentations): B2BALTIC Business Travels Department.

Trade fair meetings in Latvia

Latvian trade fairs usually connect many of our members in B2BALTIC. This is also a good opportunity for business networks, meetings and deals, if you reserve your place in Hotel in advance and inform us of B2BALTIC on time. Here you can find the list of next trade fairs in the main city of Latvia.

Download Complete “Legal Guide” for Doing Business in Latvia

You get your free legal guide for Latvia with information for immigration, taxation, investment requirments, State fees, general running costs: just fill-up below.

[wpforms id=”2151″ title=”false” description=”false”]

The Nordic Baltic Channel for Media and Industries uses cookies to increase performance, however, caring about your privacy, selecting the cookies,

The Nordic Baltic Channel for Media and Industries uses cookies to increase performance, however, caring about your privacy, selecting the cookies,